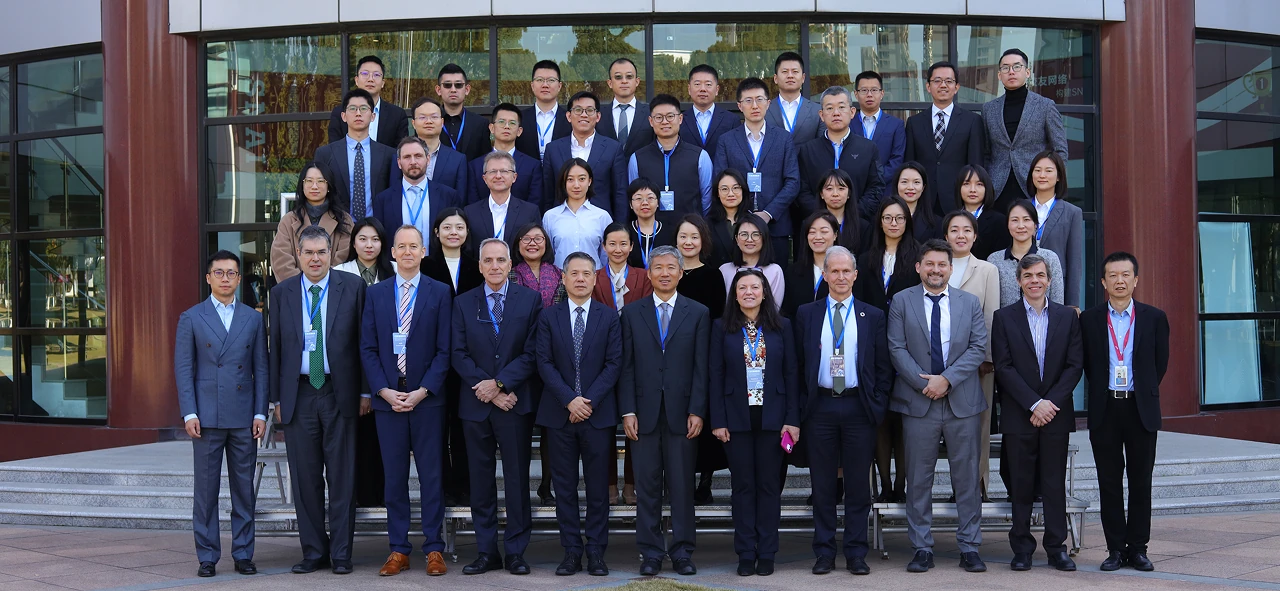

International Financial Institution (IFI) lessons and insights on how infrastructure financiers can effectively manage sovereign credit risks were the focus of a Multilateral Cooperation Center for Development Finance (MCDF) workshop cohosted with the Asian Infrastructure Investment Bank (AIIB), World Bank, and Asia-Pacific Finance and Development Institute (AFDI) on 9-10 December 2025 in Shanghai.

The workshop was tailored for industry practitioners in China, with participants including the sovereign lending, risk management, and project finance staff of the country’s key banks and financial institutions investing overseas. MCDF CEO Zhongjing Wang opened the event by emphasizing the importance of learning from IFIs which have developed systems, instruments, and skills for managing sovereign credit risks in financing infrastructure. He said these improvements are enabling IFIs to continue lending to developing countries despite the challenging environment and noted that MCDF has developed a number of knowledge-sharing resources on debt sustainability, including the Handbook on Sustainable Financing of Development and Infrastructure.

Dr. Manuela Francisco, Global Director for Economic Policy in the Prosperity Vertical at the World Bank Group, presented the key features of the current difficult debt restructuring landscape in which 52% of low-income countries are at high risk of external debt distress or are already in debt distress. Improving coordination frameworks between borrowers and creditors are helping to address the solvency and liquidity issues of these countries and borrowing internationally continues to be essential for their sustainable development provided that the financing terms are appropriate and transparent, Dr. Francisco noted.

Dr. Erik Berglöf, Chief Economist at the Asian Infrastructure Investment Bank (AIIB), highlighted a cross-section of IFI good practices. They included project design that ensures positive economic and financial returns, innovative financing such as equity or guarantees that are non-debt creating, and assessing risks through International Monetary Fund (IMF) and World Bank debt sustainability assessments (DSAs).

After additional opening remarks by AFDI President Wenbing Lu, experts from Standard & Poor’s Global Ratings, the IMF, World Bank, and AIIB shared their perspectives on evaluating sovereign risk, followed by a practical exercise to help workshop participants learn how to use the IMF and World Bank’s DSAs.

On workshop day two, experts from the World Bank and IMF provided an update on recent developments in sovereign debt restructuring. They discussed the Global Sovereign Debt Roundtable’s role, practical guidance on debt restructuring processes, and the IMF and World Bank’s Three-Pillar Approach to help countries manage liquidity problems. Dr. Marcelo Giugale, Senior Adviser to the MCDF CEO, presented on how the debt sustainability landscape is likely to evolve in the future, including proposals for new sovereign debt resolution mechanisms.

The workshop concluded with a look at the practical tools and practices financiers can employ to continue financing infrastructure following debt restructuring, such as credit guarantees, co-financing with IFIs, and strategies for managing risk across a portfolio of countries. Speakers included representatives from the Multilateral Investment Guarantee Agency of the World Bank Group, United Kingdom Export Finance, AIIB, and the Industrial and Commercial Bank of China.

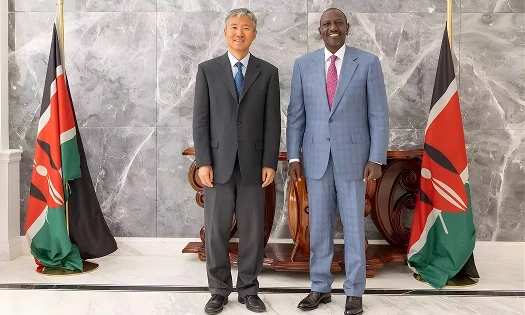

Following the workshop, CEO Wang and President Lu met to discuss opportunities for further MCDF-AFDI cooperation.

Contact

David Hendrickson

Senior Communications Officer

Mobile: +86 185 0114 6758

david.hendrickson@themcdf.org