ABOUT MCDF

The Multilateral Cooperation Center for Development Finance (MCDF) promotes high-quality connectivity infrastructure investment in developing countries through partnerships.

OUR WORK AREAS

PORTFOLIO SNAPSHOT

-

Approved Grants

59

-

Approved Amount

77.6

USD million

-

Projected Investment Mobilization

12.7

USD billion

SUPPORTED PROJECTS

Supported Project - Country (Cross-Border)

Supported Project - Regional

INFORMATION SHARING

Event Participants

7,298

New Partners*

99

*New Partners = developing country financiers

Beneficiary Countries

113

Projects Presented to Financiers

98

Data as of 31 December 2025

LATEST EVENTS

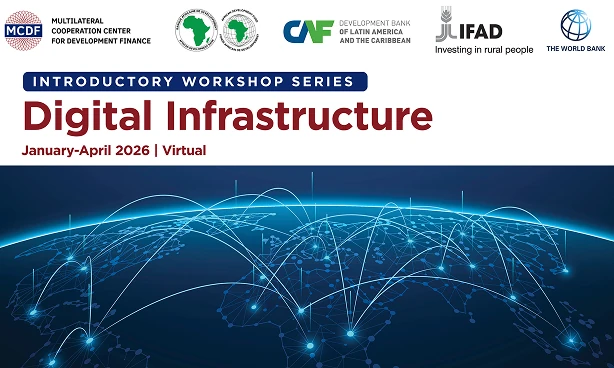

Digital Infrastructure Introductory Workshop Series

The digital economy is the fastest growing sector worldwide in terms of GDP and jobs and depends crucially on digital infrastructure to support it.